HCi Factsheet

Making health insurance easy!

Annual private health tax statements

current June 2024

Your private health tax statement is a useful document containing information about your health cover and rebate for the financial year.

The Australian Government no longer requires health funds to provide tax statements to members, for the purposes of completing an annual income tax return.

Instead, each year we provide the Australian Tax Office (ATO) with the relevant tax information needed, so they can pre-populate your online tax return. We usually complete this by mid July each year.

So, if you do your tax online, or through an accountant, you don’t need to do anything!

Understanding your private health tax statement

The content and format of the Tax Statement can be confusing. As it is prescribed by law, the statement can’t be changed by HCi, other than to populate the required fields with the information you need to complete your tax return. Please visit the Australian Tax Office (ATO) website for more guidance regarding the use of your private health tax statement.

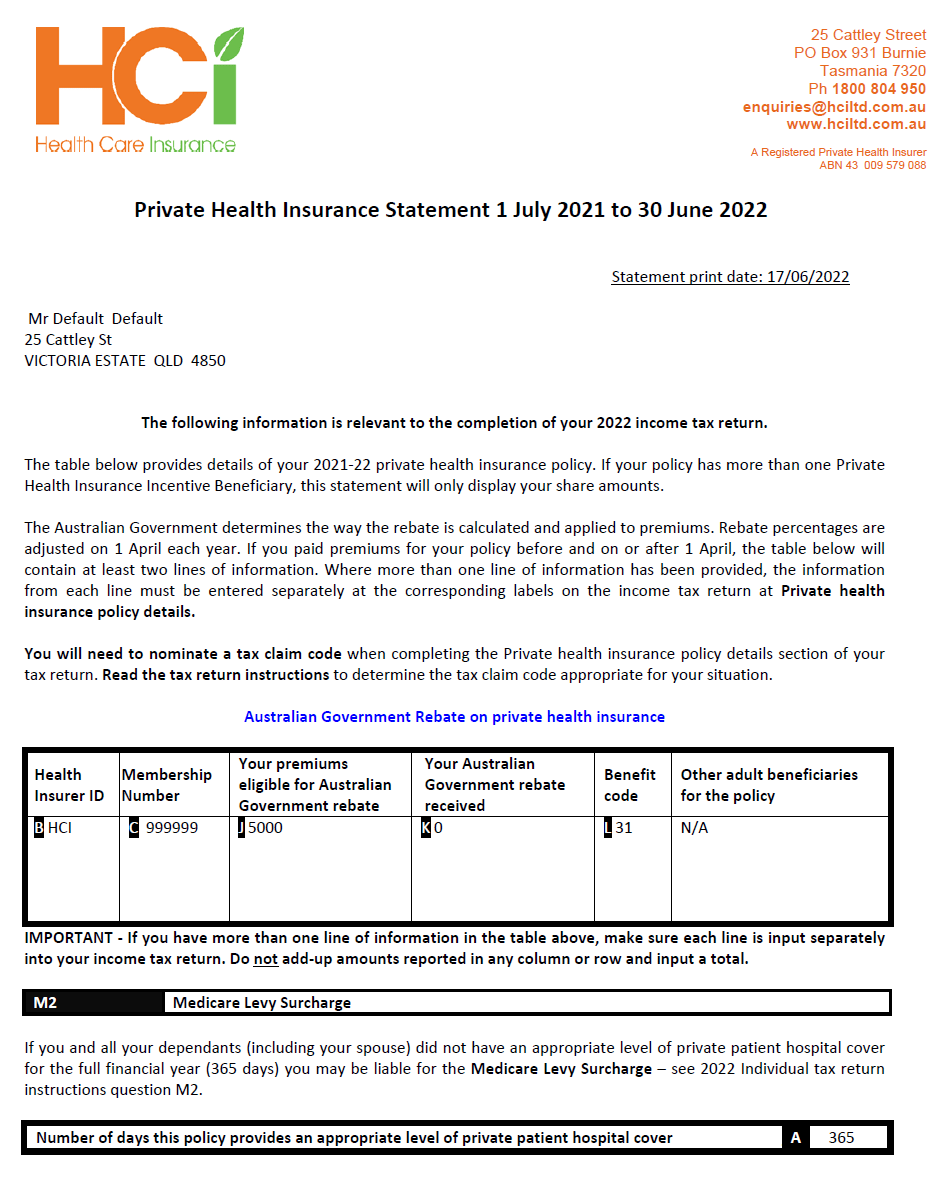

For the relevant financial year, your private health tax statement outlines:

- the premiums you have paid to HCi that are eligible for the Australian Government Rebate,

- the amount of Rebate you received (if any),

- details of any other eligible adults who were on your policy at any point (for example your partner), and

- the number of days you held appropriate private hospital cover during the financial year (this helps determine if you have to pay an extra Medicare Levy Surcharge)

Finding your Private Health Tax Statement

Want to see your statement or get a copy for your tax records? It’s easy!

![]() Log into your ATO MyTax portal

Log into your ATO MyTax portal

![]() Ask your tax agent, if you have one

Ask your tax agent, if you have one

HCi used its best endeavours to ensure this information was accurate at the time of publication. From time to time, circumstances relating to the subject matter may change which may impact the accuracy of the information. This information is also general in nature and does not take into account any specific health or financial situation. Before making any decisions in relation to this information, you should consider your own financial and health situation and seek professional advice. Health Care Insurance Ltd ABN 43 009 579 088. A Registered Private Health Insurer.